Performance monitoring of stocks chosen according to the DividendQuality stock rating strategy.

From the stock rating results, the first 25 stocks with the highest total score are chosen. This is done for ease of evaluations and presentation. As mentioned before, I think that the cheerful part of stock buying begins with further examination of the stock features and the companies. So, the performance presented here, is really completely algorithm and number based. Pure strategy application and no further decision making, no think twice.

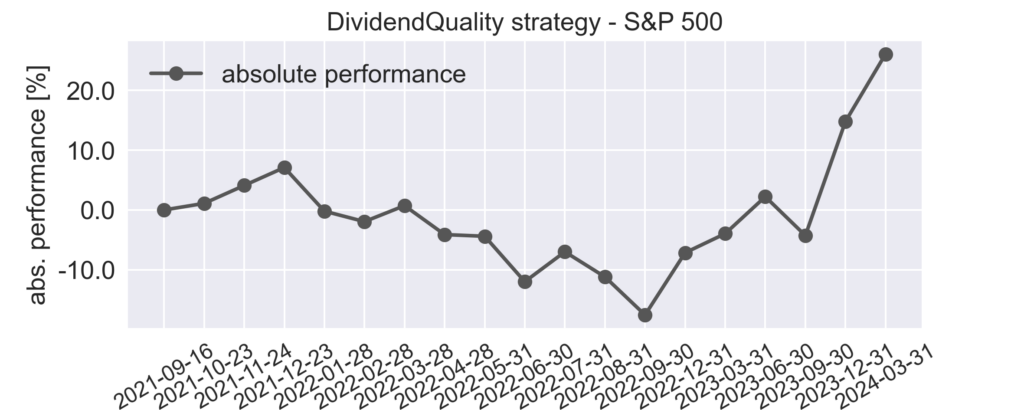

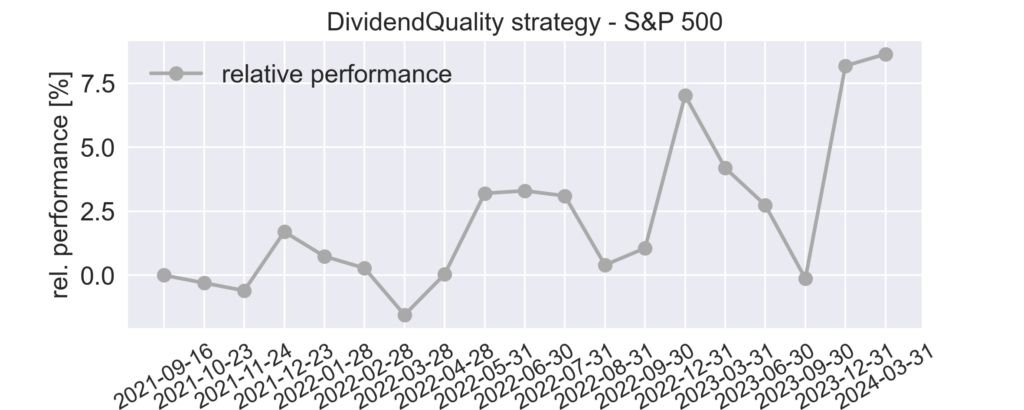

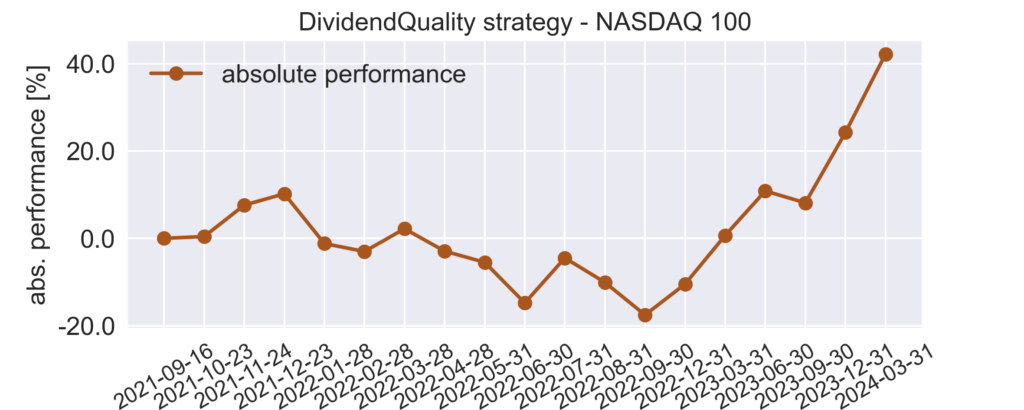

To measure performance, the portfolio performance is calculated by means of percentage values of the overall portfolio. Stocks are assumed to be equally weighted in the portfolio. The first measure is the absolute percentage performance of the portfolio. The second measure is the percentage performance of the portfolio relative to an index. Both performance measures are plotted as line charts.

Cost and performance factors like trading costs, taxes and dividend payments are not included in the performance calculations.

Performance evaluations

- S&P 500 – Performance based on stock rating from September 2021 + trading

- S&P 500 – Portfolio/trading history

- NASDAQ 100 – Performance based on stock rating from September 2021 + trading

- NASDAQ 100 – Portfolio/trading history

S&P 500 – Performance based on stock rating from September 2021 + trading

S&P 500 – Portfolio/trading history

The portfolio history of the DividendQuality strategy – S&P 500 – is shown below:

Scoring date: 2023-01-15

Portfolio: DHI, RF, PFE, ADI, AVGO, PNC, MPWR, SNA, MSCI, ABBV, NDSN, IEX, ABT, NSC, TXN, PFG, DFS, FITB, GLW, HIG, INTU, MCO, LRCX, APH, PHM

Scoring date: 2022-09-18

Portfolio: SNA, PFG, RF, APH, PFE, LEN, AVGO, A, AVY, FITB, ABT, UNH, PNC, RSG, ADI, NSC, NDAQ, MCO, TXN, MRK, PHM, NUE, AMP, ZION, DFS

Scoring date: 2022-05-14

Portfolio: MRK, FITB, PFE, TSN, SNA, ABT, KEY, INTU, ALL, LEN, DFS, NSC, TXN, PHM, DGX, HIG, JNJ, K, HSY, KLAC, APH, KR, CTAS, PFG, HPQ

Scoring date: 2021-09-16

Portfolio: LEN, MSFT, UNH, INTU, LRCX, PHM, AVY, PFG, TSN, ALL, AMAT, SPGI, NOC, DGX, CSCO, SYK, TXN, USB, KLAC, HSY, KEY, ADI, ABT, INTC, PFE

NASDAQ 100 – Performance based on stock rating from September 2021 + trading

NASDAQ 100 – Portfolio/trading history

The portfolio history of the DividendQuality strategy – NASDAQ 100 – is shown below:

Scoring date: 2023-01-15

Portfolio: ADI, AVGO, CSCO, TXN, INTU, LRCX, ADP, CTAS, PAYX, MCHP, KLAC, AMAT, MDLZ, NVDA, AMGN, MSFT, HON, ATVI, GILD, QCOM, AAPL, NXPI, ROST, FAST, CSX

Cash: 0 % of the total amount (cash + portfolio value)

Scoring date: 2022-09-20

Portfolio: AVGO, ADI, TXN, AMAT, LRCX, INTU, CSX, ATVI, KLAC, MSFT, AAPL, ADP, MDLZ, AMGN, NVDA, CTAS, MCHP, SBUX, MU, VRSK, PAYX, COST, EA

Cash: 9 % of the total amount (cash + portfolio value)

Scoring date: 2022-05-16

Portfolio: INTU, TXN, LRCX, KLAC, CTAS, MDLZ, ATVI, NVDA, SIRI, AMAT, MSFT, AAPL, ADP, ADI, AMGN, AVGO, CSX, PAYX, MU, COST, MCHP, CTSH, CERN, EA, VRSK

Scoring date: 2021-09-16

Portfolio: MSFT, LRCX, INTU, KLAC, CSCO, TXN, AMAT, AMGN, ADI, INTC, XLNX, FAST, NVDA, SWKS, CMCSA, ADP, ROST, GILD, CTAS, CERN, PAYX, VRSK, AAPL, CSX, MDLZ